In the ever-evolving landscape of the Dallas-Fort Worth Metroplex real estate market, Hallgate Management introduces a fresh perspective to conventional property management. With leveraging localized expertise, we specialize in delivering boutique services tailored for mid-rise, garden-style, value-add, and new construction apartment homes.

As we step into the final month of 2023, it’s essential to analyze the trends and developments shaping the local real estate scene. In this comprehensive monthly market update, we delve into key indicators, changes, and sales figures to provide a nuanced understanding of the current state of affairs in the Dallas-Fort Worth Metroplex.

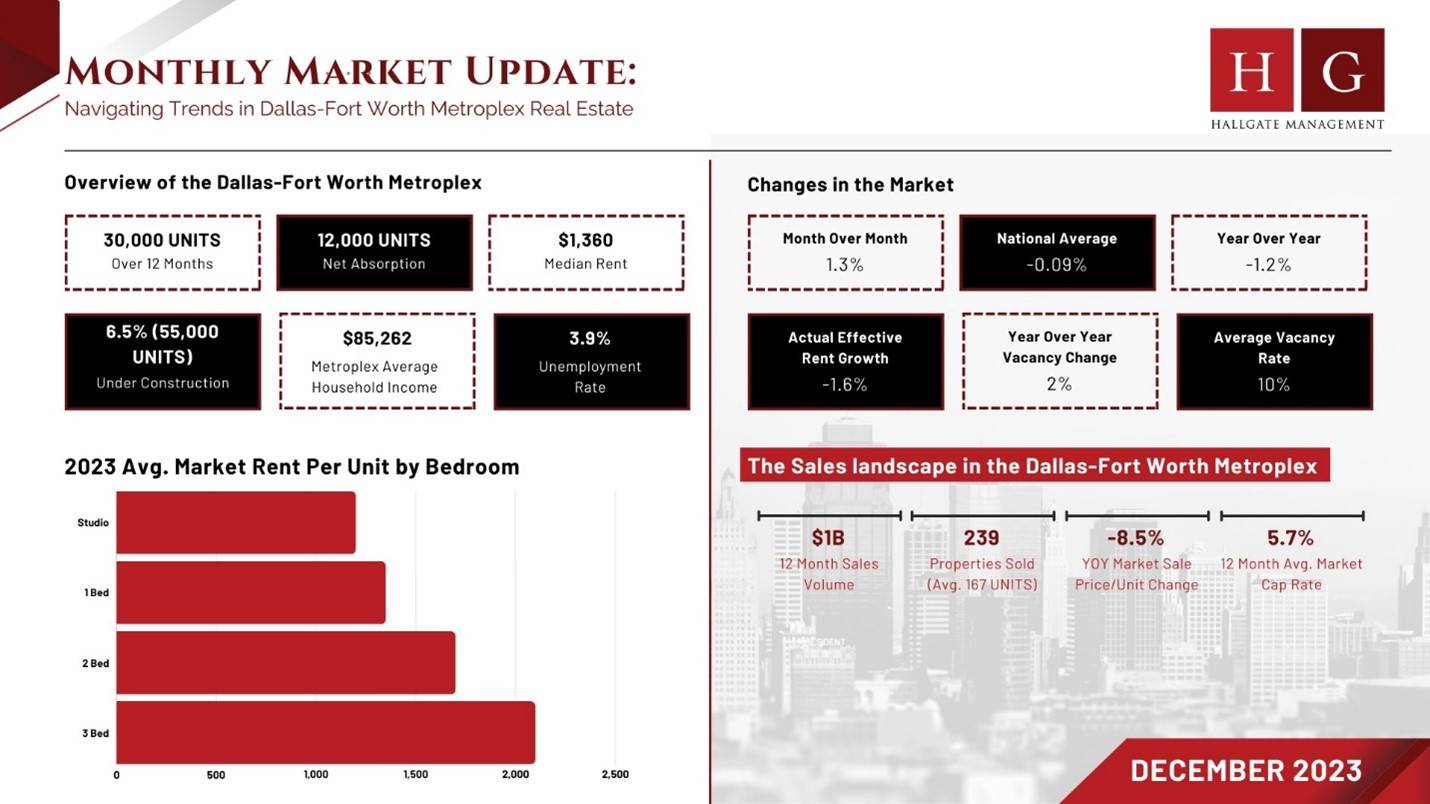

Over the past 12 months, the Dallas-Fort Worth Metroplex has witnessed the delivery of over 30,000 units, reflecting the region’s robust growth in the housing sector. The net absorption trend is noteworthy, with more than 12,000 units filled in the first three quarters of the year. Median rent remains stable at $1,360, indicating a resilient market.

Market temperatures are warm, with 6.5% of the inventory currently under construction, representing approximately 55,000 units. This highlights the sustained development and expansion in the housing sector, catering to the demands of a growing population.

Changes in the Market

Despite the overall positive outlook, certain changes are noteworthy. The month-over-month change in rent stands at -1.3%, contrasting with the national average of -0.09%. The year-over-year change in rent is -1.2%, signifying a shift towards negative growth over the past year. This decline is attributed to supply-heavy submarkets, resulting in an actual effective rent growth rate of -1.6%.

Vacancy rates have experienced a 2% year-over-year change, with the current average vacancy rate hovering around 10%. While this figure indicates a relatively stable market, property owners and managers should remain vigilant and responsive to any shifts in demand.

Sales Figures

The sales landscape in the Dallas-Fort Worth Metroplex is dynamic, with a 12-month sales volume reaching an impressive $1 billion. A total of 239 properties changed hands during this period, with an average of 167 units per property. The 12-month average market cap rate stands at 5.7%, with the lowest recorded at 4.1% and the highest at 9%.

However, a notable change in the year-over-year market sale price per unit reveals a decline of 8.5%. This decline suggests a recalibration in property values and emphasizes the importance of strategic decision-making for property investors and developers.

Economic Indicators

Understanding the economic context is crucial for interpreting real estate trends. In the Dallas-Fort Worth Metroplex, the average household income is around $85,262, providing a solid foundation for sustained growth in the housing market. The unemployment rate, a key indicator of economic health, is at 3.9%, showcasing a resilient and stable employment landscape.

All in All,

As we conclude our December Monthly Market Update for 2023, it’s evident that the Dallas-Fort Worth Metroplex remains a dynamic and promising real estate market. Hallgate Management’s dedication to prioritizing people, delivering boutique services, and maintaining transparent communication positions us as a trusted partner in navigating the intricacies of property management.

While challenges such as negative rent growth and shifts in property values persist, the Metroplex’s economic strength, coupled with ongoing development projects, bodes well for the future. As we step into the new year, Hallgate Management remains steadfast in its commitment to fostering relationships and leveraging localized expertise, ensuring a resilient and prosperous residential living experience for the communities we serve in the Dallas-Fort Worth Metroplex.